US Fed Rate Cut: Impact on the Indian Stock Market

Share

A US Fed Rate cut often sets off a domino effect in global markets. India—one of the world’s fastest-growing economies—is significantly influenced by these monetary shifts. Here’s how a Fed rate cut ripple can play out for Indian equities.

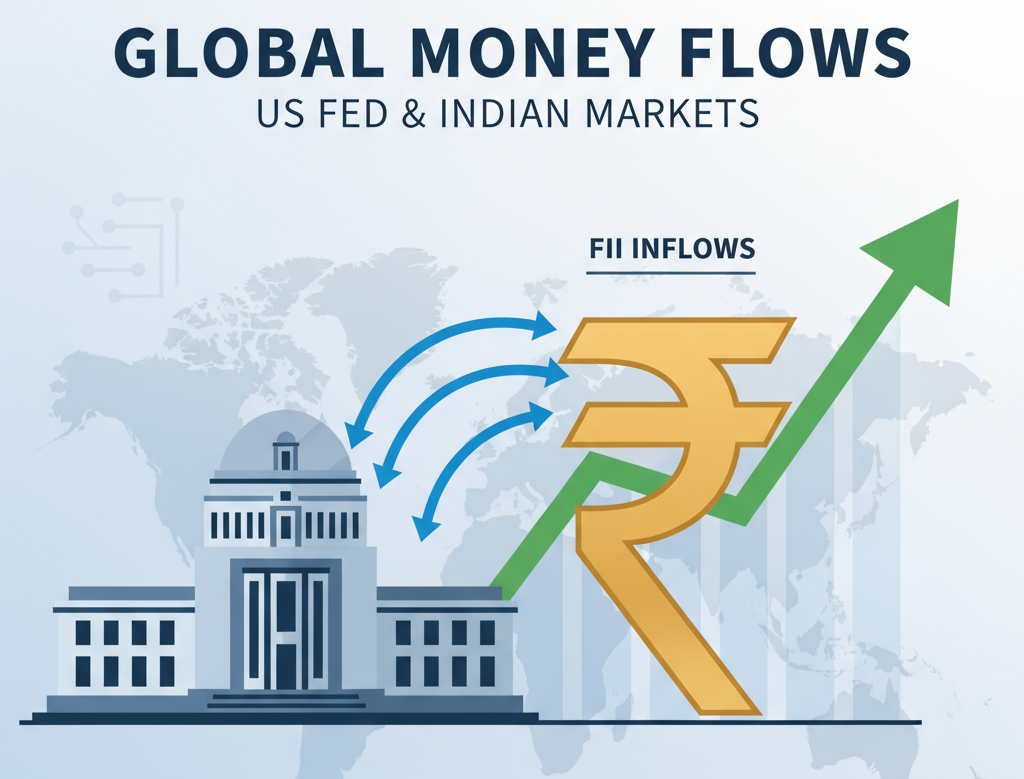

US Fed Rate Cut : Step-by-Step Impact Flow

1. Increase in Foreign Institutional Investor (FII) Inflows into India

Lower US interest rates make emerging markets like India more attractive—a trend visible during recent Fed easings (e.g., 2020 COVID phase).

- Dollar-based funds seek better yields, driving FII inflows into Indian stocks and bonds.

- Example: In early 2020, FII inflows surged after the Fed slashed rates to near zero, boosting Indian indices like Nifty and Sensex.

2. Stabilization & Strengthening of Indian Rupee

With more foreign capital entering India, demand for the rupee rises.

- This supports rupee stability, sometimes even appreciation, which benefits importers and helps moderate inflation.

3. Boost to Interest Rate-Sensitive & Export Oriented Sectors

- Sectors such as banking, auto, real estate, and IT can benefit.

- Example: Banking stocks often rally when rate cuts trigger lower borrowing costs and higher loan growth.

- Export-oriented sectors (like IT and pharma) benefit from global liquidity and stable currency.

4. Expectation of RBI Rate Cuts in India

- The Reserve Bank of India may follow the Fed’s lead, with prospects of rate cuts to keep the currency competitive and support growth.

- Example: In 2019, RBI reduced rates several times after US Fed cuts, aiding stocks in lending and consumption sectors.

5. Improved Market Sentiment with Cautious Optimism

- End result: Indian markets witness a positivity boost amid optimism, though global uncertainties (war, inflation, recession fears) still moderate exuberance.

Quick Reference Table: Impact Summary

Impact AreaDescription & ExampleFII InflowsRise in flows (e.g., $10bn in 2020 Q2)Rupee StrengthRupee gains from ₹75/$ to ₹71/$ (example)Export SectorsIT stocks rally after Fed cutsRBI Rate ExpectationsRBI trims repo rate in syncMarket MoodNifty moves up 12%, with volatility

Illustrative Flowchart

US Fed Rate Cut

↓

Increase in FII Inflows

↓

Indian Rupee Stabilization

↓

Interest-Sensitive Sector Boost

↓

RBI Rate Cut Expectation

↓

Improved Market Sentiment

Concept: FII Inflows vs Nifty Movement

- The blue line shows FII inflows, peaking in Q1 2020 with $10.2 billion inflows.

- The orange line plots Nifty 50 returns, which also saw a strong positive movement following the inflow surges.

- The chart highlights the clear correlation between foreign capital inflows and Indian market performance during Fed easing phases.

Note on Macroeconomic Uncertainties

While these factors typically yield a positive market impact, ongoing global risks—like volatile commodity prices, recession fears, or geopolitical tensions—mean moderate volatility may persist. Investors should balance optimism with careful risk assessment.

Conclusion

A US Fed rate cut often brings a chain reaction of increased FII inflows, rupee stabilization, sectoral rallies, and improved market sentiment in India. Using real data and disciplined investment strategy helps harness these opportunities, while diversifying against persistent global risks.

For more actionable insights into navigating rate cycles and maximizing returns, consult a financial advisor with proven macro expertise.